edge computing cloud

#image_title #site_title #post_seo_title #image_seo_title

Edge computing, a technology that is proving to be very beneficial for financial services and other industries, is currently gaining traction across the world. The technology offers several advantages, such as low latency, data security, and cost-effectiveness, making it an essential tool for financial institutions, especially in today’s fast-paced industry.

Edge Computing in Financial Services

Abstract

The financial services industry is undergoing rapid transformation due to advances in technology. Edge computing has emerged as a key player in this field, offering several benefits to businesses. This article explores the advantages of edge computing in financial services, including enhanced security, lower latency, and reduced costs.

Introduction

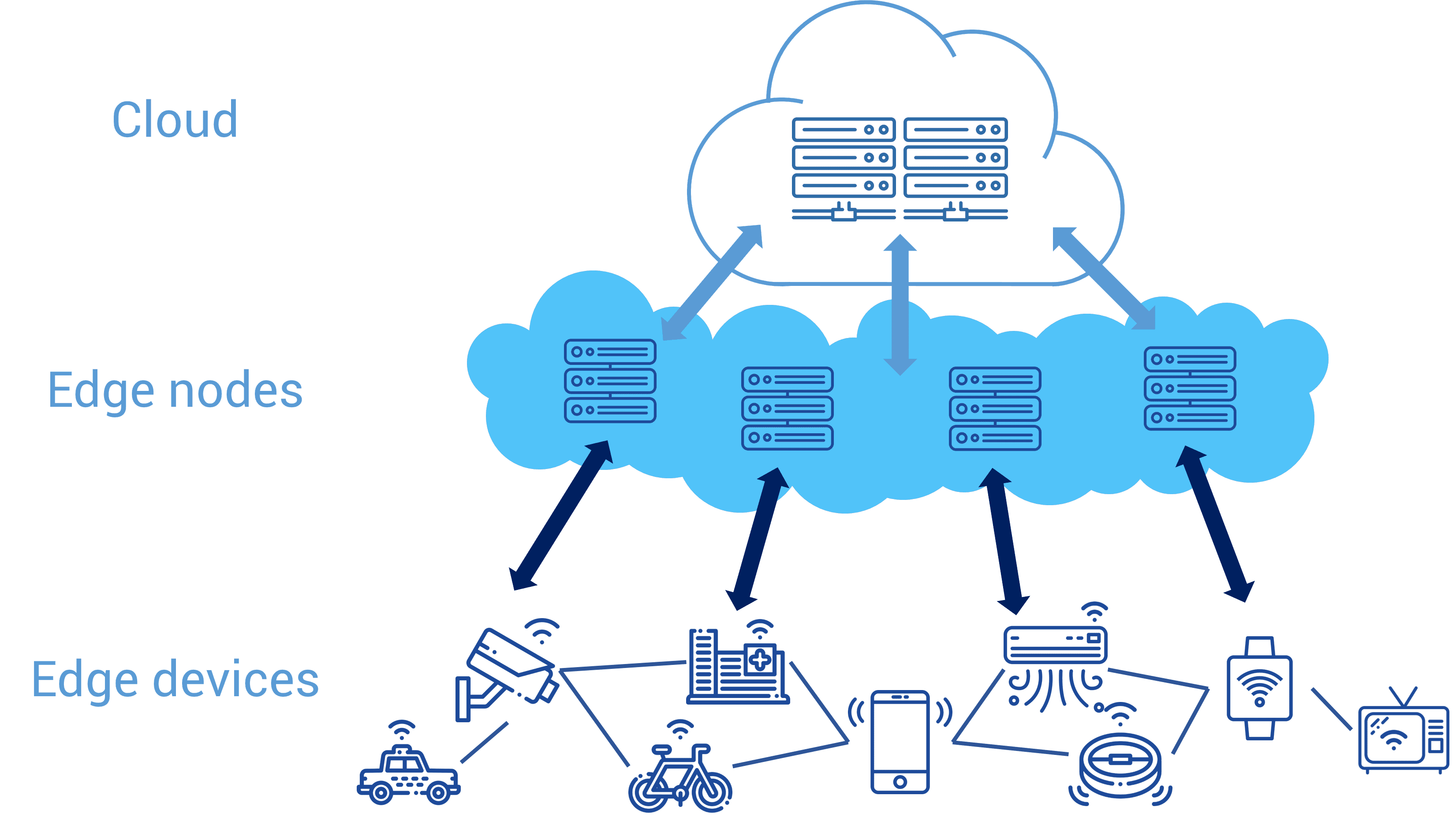

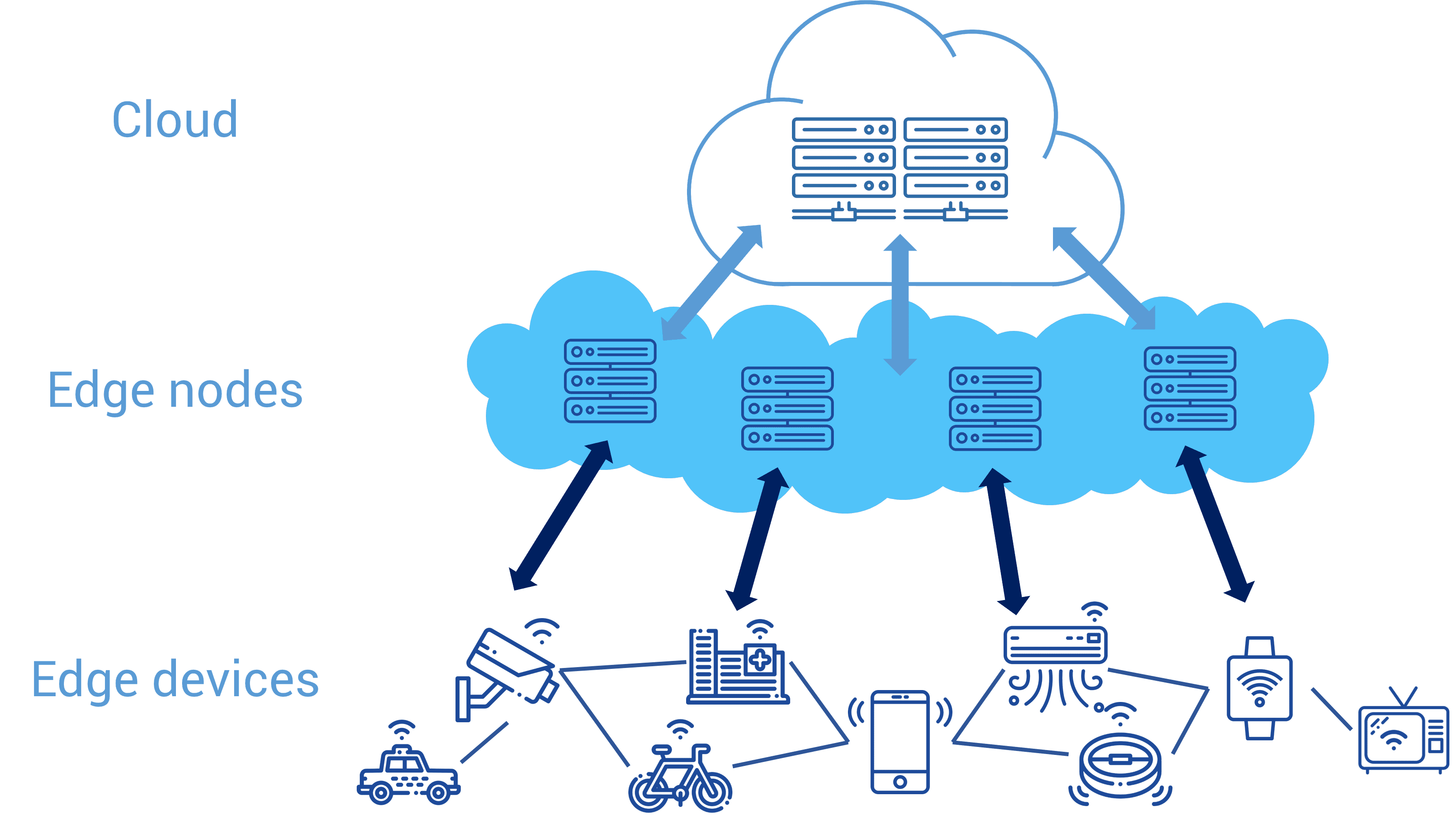

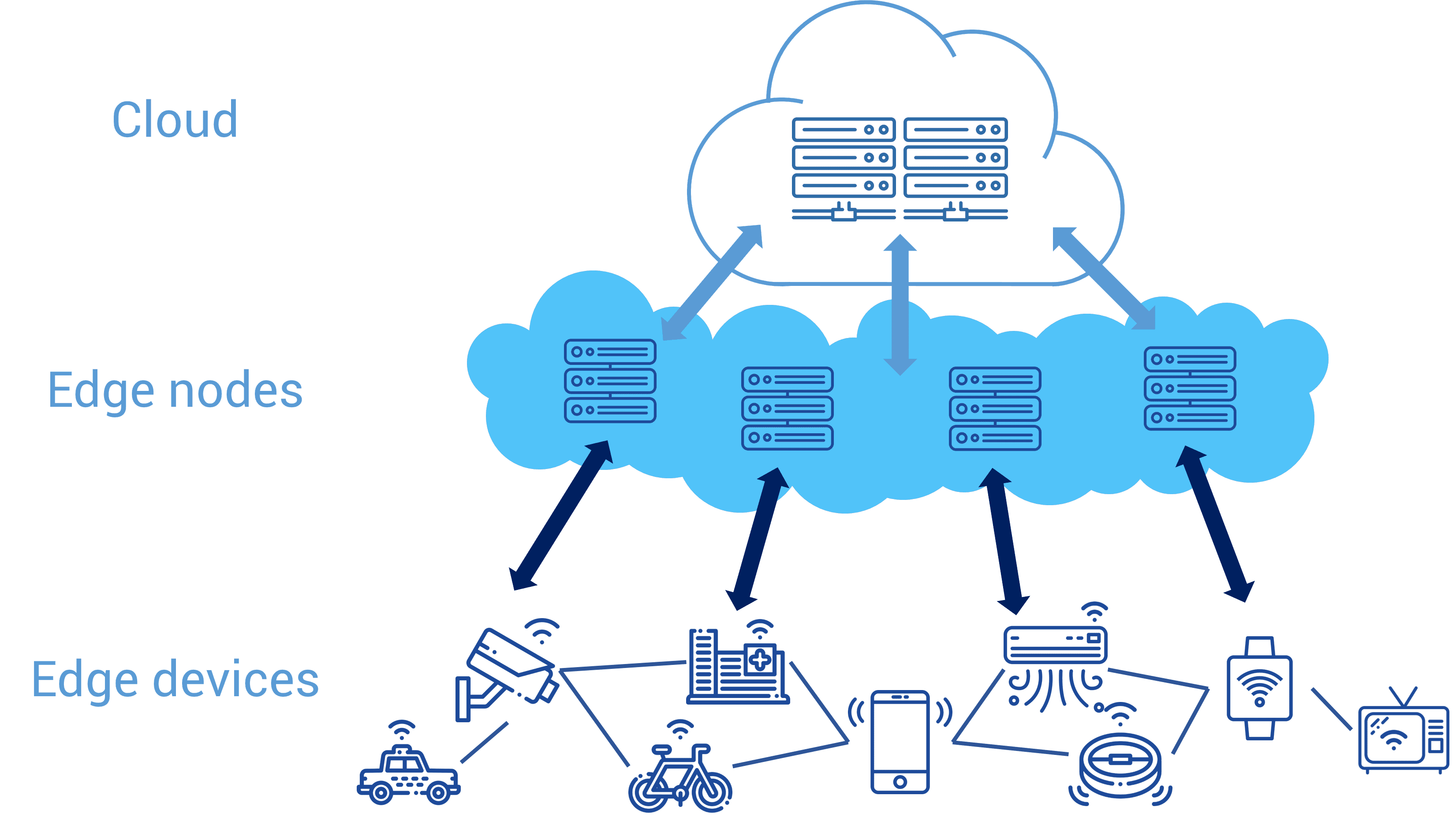

Edge computing is a technology that enables processing and storage of data near the edge of a network, closer to the source of data. It is a decentralized computing infrastructure that moves computing power and storage closer to where it is needed. The traditional model of cloud computing involves data processing and storage in a centralized location, which can often result in latency issues and security vulnerabilities.

Edge computing can provide significant benefits to businesses, particularly in the financial services industry. Banks and other financial institutions are constantly looking for ways to improve their efficiency and reduce costs. Edge computing can help them achieve these objectives by providing faster processing speeds, improved security, and reduced network congestion. Additionally, edge computing can enable financial institutions to process large volumes of data in real-time, which is essential for making quick and informed business decisions.

Advantages of Edge Computing in Financial Services

Enhanced Security

Data security is a top priority for financial institutions. Edge computing can provide enhanced security by reducing the need to transfer data between a central location and remote devices. This can minimize the risk of data being intercepted and compromised during transmission. Additionally, edge computing can offer improved security by providing a secure environment for data processing and storage, making it more difficult for cyber attackers to gain unauthorized access to sensitive information.

Edge computing can also help financial institutions comply with regulatory requirements, particularly those related to data privacy and security. By keeping data processing and storage close to the source of data, edge computing can ensure that sensitive information remains within a secure environment, reducing the risk of non-compliance with regulations.

Lower Latency

Low latency is essential in the financial services industry, particularly in high-frequency trading and other time-sensitive applications. Edge computing can provide low latency by reducing the time it takes to process data. By processing data at the edge of the network, closer to the source of data, it can significantly reduce the latency time. This can result in improved business performance and a competitive advantage for financial institutions.

Furthermore, edge computing can help reduce network congestion, which is a common cause of latency issues. By processing data locally, edge computing can help reduce the amount of data that needs to be transmitted across the network, resulting in faster data processing and communication speeds.

Reduced Costs

The financial services industry is under constant pressure to reduce costs. Edge computing can provide cost savings by reducing the need for businesses to invest in expensive hardware and infrastructure. With edge computing, businesses can process and store data closer to the source of data, reducing the need for expensive data centers and maintaining large server farms.

Additionally, edge computing can help reduce network costs, particularly in remote or rural areas. Traditional cloud computing requires a high-speed, low-latency network connection, which can be costly to implement, particularly in areas with poor connectivity. Edge computing, on the other hand, can operate with a lower bandwidth connection, making it more cost-effective in areas with poor connectivity.

Conclusion

In conclusion, edge computing can provide significant benefits to financial institutions, particularly in terms of enhanced security, lower latency, and reduced costs. The technology is quickly gaining traction across the world and is expected to become increasingly important in the financial services industry in the future.

With the advantages of edge computing, financial institutions can improve their performance, reduce their costs, and stay ahead of the competition. By embracing this technology, businesses can ensure they remain at the forefront of technological innovation and continue to provide their customers with the highest quality of service.

Source image : www.alibabacloud.com

Source image : www.cbinsights.com

Source image : www.deltecbank.com