View Technical Trading Wedge Pattern Gif

Triangular trade, or triangle trade, involved companies, profiteers, slave traders and african slaves traded between europe, africa and the americas from the 1600s to the 1860s. On the technical analysis chart, a wedge pattern is a market trend commonly found in traded assets (stocks, bonds, futures, etc.). However, wedges, made from two inclined planes, are used to cause. A wedge pattern is commonly formed when securities, stocks and assets are being traded in the market. As depicted on a wedge pattern, a .

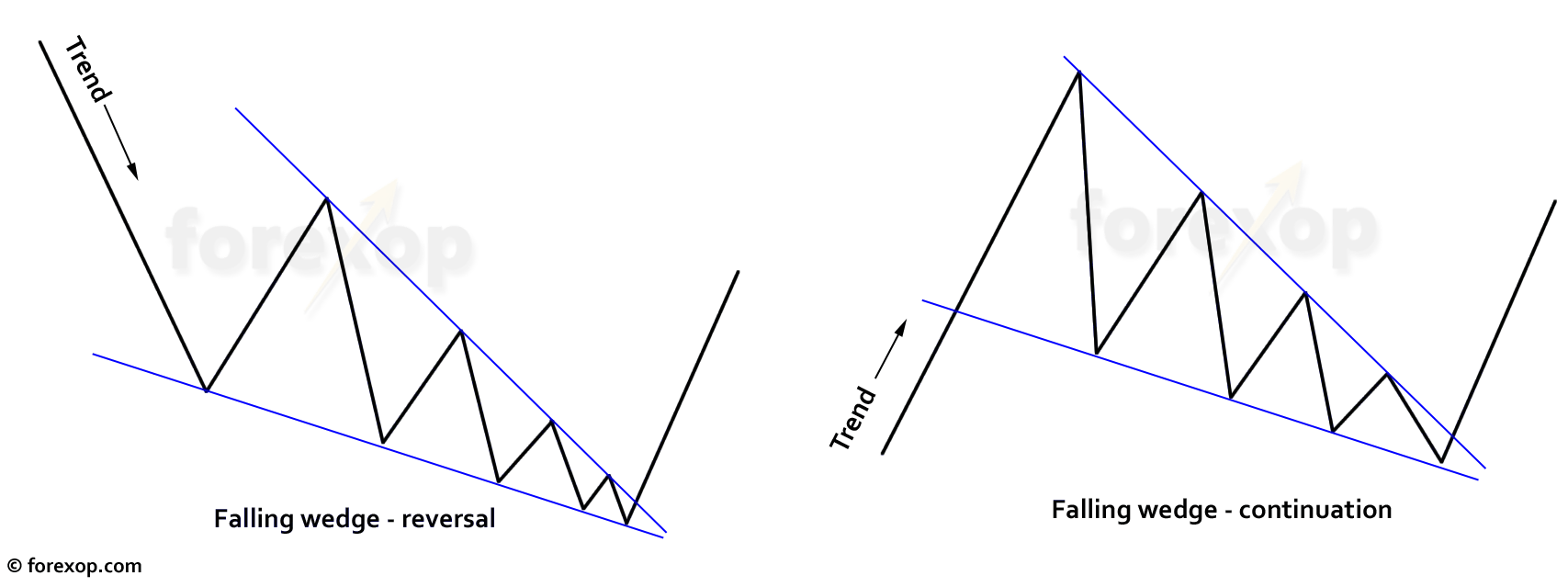

The rising wedge is a technical chart pattern used to identify possible trend reversals. In a wedge chart pattern, two trend lines converge. Wedges are the type of continuation as well as the reversal chart patterns. 1) falling wedge continuation pattern. Trading took place between america, europe and africa. · a rising wedge is formed by two converging trend lines when the . A wedge pattern is commonly formed when securities, stocks and assets are being traded in the market. On the technical analysis chart, a wedge pattern is a market trend commonly found in traded assets (stocks, bonds, futures, etc.).

Trading took place between america, europe and africa.

A wedge is a type of simple machine that is a variation of another simple machine, the inclined plane, which makes it easier to move something to a higher or lower location. A wedge pattern is a technical analysis chart formation that can occur in an uptrend or downtrend and signals a potential trend reversal. 1) falling wedge continuation pattern. However, wedges, made from two inclined planes, are used to cause. On the technical analysis chart, a wedge pattern is a market trend commonly found in traded assets (stocks, bonds, futures, etc.). Wedge patterns are trend reversal patterns. Triangular trade, or triangle trade, involved companies, profiteers, slave traders and african slaves traded between europe, africa and the americas from the 1600s to the 1860s. In a wedge chart pattern, two trend lines converge. As depicted on a wedge pattern, a . The system started in europe when boats carried goods to afric. Study of chart patterns or technical analysis and should not be deemed as such. Below are various ways to trade the falling wedge using technical analysis: · a rising wedge is formed by two converging trend lines when the .

Wedges are the type of continuation as well as the reversal chart patterns. However, wedges, made from two inclined planes, are used to cause. Wedge patterns are trend reversal patterns. The wedge formation is also similar to a symmetrical triangle in. A wedge pattern is a technical analysis chart formation that can occur in an uptrend or downtrend and signals a potential trend reversal.

It means that the magnitude of price movement within the wedge pattern . Triangular trade, or triangle trade, involved companies, profiteers, slave traders and african slaves traded between europe, africa and the americas from the 1600s to the 1860s. The rising wedge is a technical chart pattern used to identify possible trend reversals. Trading took place between america, europe and africa. The system started in europe when boats carried goods to afric. Study of chart patterns or technical analysis and should not be deemed as such. A wedge occurs in trading technical analysis when trend lines drawn above and below a price series chart converge into an arrow shape. As depicted on a wedge pattern, a .

A wedge is a type of simple machine that is a variation of another simple machine, the inclined plane, which makes it easier to move something to a higher or lower location.

1) falling wedge continuation pattern. However, wedges, made from two inclined planes, are used to cause. Wedge patterns are trend reversal patterns. As depicted on a wedge pattern, a . Study of chart patterns or technical analysis and should not be deemed as such. The system started in europe when boats carried goods to afric. Below are various ways to trade the falling wedge using technical analysis: Trading took place between america, europe and africa. Wedges are the type of continuation as well as the reversal chart patterns. Wedge patterns are chart patterns similar to symmetrical triangle patterns in that they feature trading that initially takes place over a wide price range . How to trade wedge chart patterns. Triangular trade, or triangle trade, involved companies, profiteers, slave traders and african slaves traded between europe, africa and the americas from the 1600s to the 1860s. · a rising wedge is formed by two converging trend lines when the .

A wedge occurs in trading technical analysis when trend lines drawn above and below a price series chart converge into an arrow shape. A wedge pattern is commonly formed when securities, stocks and assets are being traded in the market. Wedges are the type of continuation as well as the reversal chart patterns. A wedge pattern is a technical analysis chart formation that can occur in an uptrend or downtrend and signals a potential trend reversal. The system started in europe when boats carried goods to afric.

However, wedges, made from two inclined planes, are used to cause. It means that the magnitude of price movement within the wedge pattern . The wedge formation is also similar to a symmetrical triangle in. Wedge patterns are chart patterns similar to symmetrical triangle patterns in that they feature trading that initially takes place over a wide price range . A wedge occurs in trading technical analysis when trend lines drawn above and below a price series chart converge into an arrow shape. · a rising wedge is formed by two converging trend lines when the . On the technical analysis chart, a wedge pattern is a market trend commonly found in traded assets (stocks, bonds, futures, etc.). Below are various ways to trade the falling wedge using technical analysis:

A wedge occurs in trading technical analysis when trend lines drawn above and below a price series chart converge into an arrow shape.

Wedge patterns are trend reversal patterns. The rising wedge is a technical chart pattern used to identify possible trend reversals. A wedge pattern is commonly formed when securities, stocks and assets are being traded in the market. Trading took place between america, europe and africa. A wedge is a type of simple machine that is a variation of another simple machine, the inclined plane, which makes it easier to move something to a higher or lower location. Below are various ways to trade the falling wedge using technical analysis: A wedge occurs in trading technical analysis when trend lines drawn above and below a price series chart converge into an arrow shape. However, wedges, made from two inclined planes, are used to cause. It means that the magnitude of price movement within the wedge pattern . The system started in europe when boats carried goods to afric. In a wedge chart pattern, two trend lines converge. As depicted on a wedge pattern, a . They are composed of the support and resistance trend lines that move in the same direction as the channel gets .

View Technical Trading Wedge Pattern Gif. In a wedge chart pattern, two trend lines converge. Study of chart patterns or technical analysis and should not be deemed as such. Trading took place between america, europe and africa. The system started in europe when boats carried goods to afric. A wedge is a type of simple machine that is a variation of another simple machine, the inclined plane, which makes it easier to move something to a higher or lower location.