edge computing database

Technology is constantly evolving, and with it, the way we conduct business. One of the latest innovations is edge computing – a revolutionary concept that is transforming the financial services industry. In this post, we explore what edge computing is, how it is used in financial services, and its potential to revolutionize the industry.

Edge Computing in Financial Services

If you’re not familiar with edge computing, here’s a quick rundown. In traditional computing, data is transmitted to a centralized data center for processing. Edge computing, on the other hand, processes data closer to the source, reducing latency and improving data security.

The financial services industry has embraced edge computing because it offers benefits that are particularly valuable to the industry. For one, the technology offers faster processing times, which is critical for financial transactions that need to be completed quickly. Edge computing also offers better data security than traditional computing, which helps protect sensitive financial data.

Abstract

The financial services industry is no stranger to innovation, and edge computing is the latest technology to capture the industry’s attention. Edge computing offers faster processing times and improved data security, which are critical for financial transactions.

Introduction

The financial services industry is constantly looking for ways to innovate and streamline business operations. One of the latest innovations is edge computing. Edge computing is an approach to computing that processes data closer to the source, reducing latency and improving data security.

Edge computing has gained significant attention from the financial services industry because it offers benefits that are particularly valuable to the industry. Faster processing times are critical for financial transactions that need to be completed quickly. Improved data security is also important, especially with the abundance of sensitive financial data that is processed daily.

What is Edge Computing?

Traditional computing involves transmitting data to a centralized data center for processing, but edge computing processes data closer to the source. This means that data is processed quicker because it doesn’t need to be transmitted to a remote data center. Edge computing also offers better data security since sensitive information doesn’t need to be transmitted across long distances.

How is Edge Computing Used in Financial Services?

The financial services industry has embraced edge computing due to the benefits it offers. For example, edge computing enables faster processing times, which is critical for financial transactions. Improved data security is also essential in the financial services industry, and edge computing provides a more secure way to process sensitive financial data.

Another way edge computing is used in financial services is to process data in a more efficient manner. Financial institutions generate vast amounts of data daily, and edge computing can help process this data quicker to gain insights. Financial institutions can use these insights to make smarter business decisions, thereby staying ahead of the competition.

Potential to Revolutionize the Financial Services Industry

Edge computing has the potential to revolutionize the financial services industry. The technology offers numerous benefits that can help financial institutions operate more efficiently and with greater security.

One of the most significant benefits of edge computing is faster processing times. Financial transactions need to be completed quickly, and edge computing enables faster processing times, which is critical to the industry.

Improved data security is also crucial in the financial services industry, and edge computing provides a more secure way to process sensitive financial data. Data is processed closer to the source, reducing the risk of data breaches and improving overall data security.

Lastly, edge computing enables financial institutions to process data more efficiently. Financial institutions generate vast amounts of data, and edge computing can help process this data quicker to gain valuable insights. Insights from edge computing can help financial institutions make smarter business decisions, which can help them stay ahead of the competition.

Conclusion

Edge computing is revolutionizing the financial services industry. The technology offers numerous benefits, from faster processing times to improved data security. Financial institutions that embrace edge computing will have a competitive advantage, and are likely to experience greater success in the years to come.

As we can see, edge computing is the latest technology that is transforming the financial services industry. Its benefits are numerous, from faster processing times to improved data security. Financial institutions that embrace edge computing will be better positioned to succeed in the years to come.

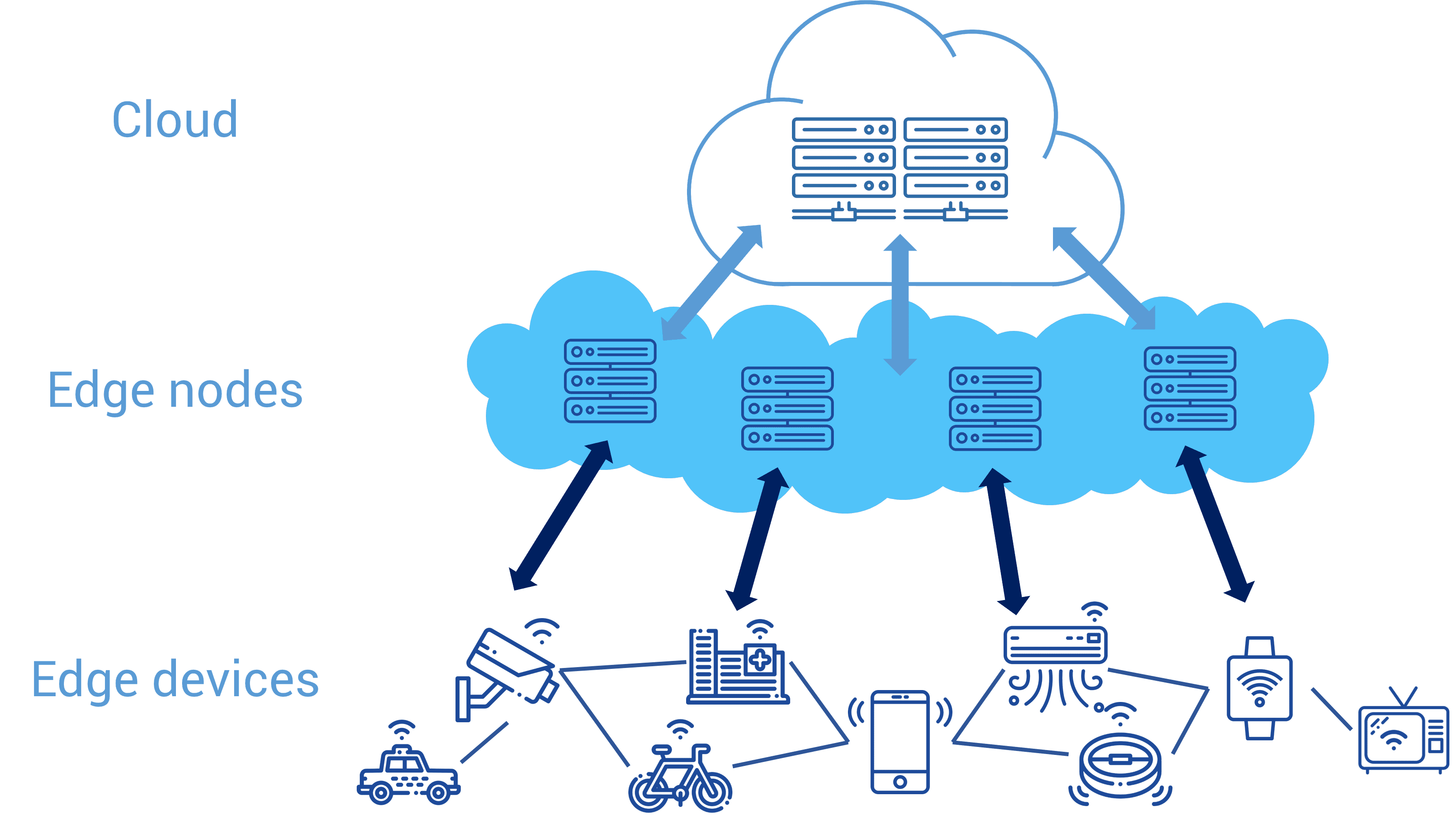

Source image : www.alibabacloud.com

Source image : www.deltecbank.com

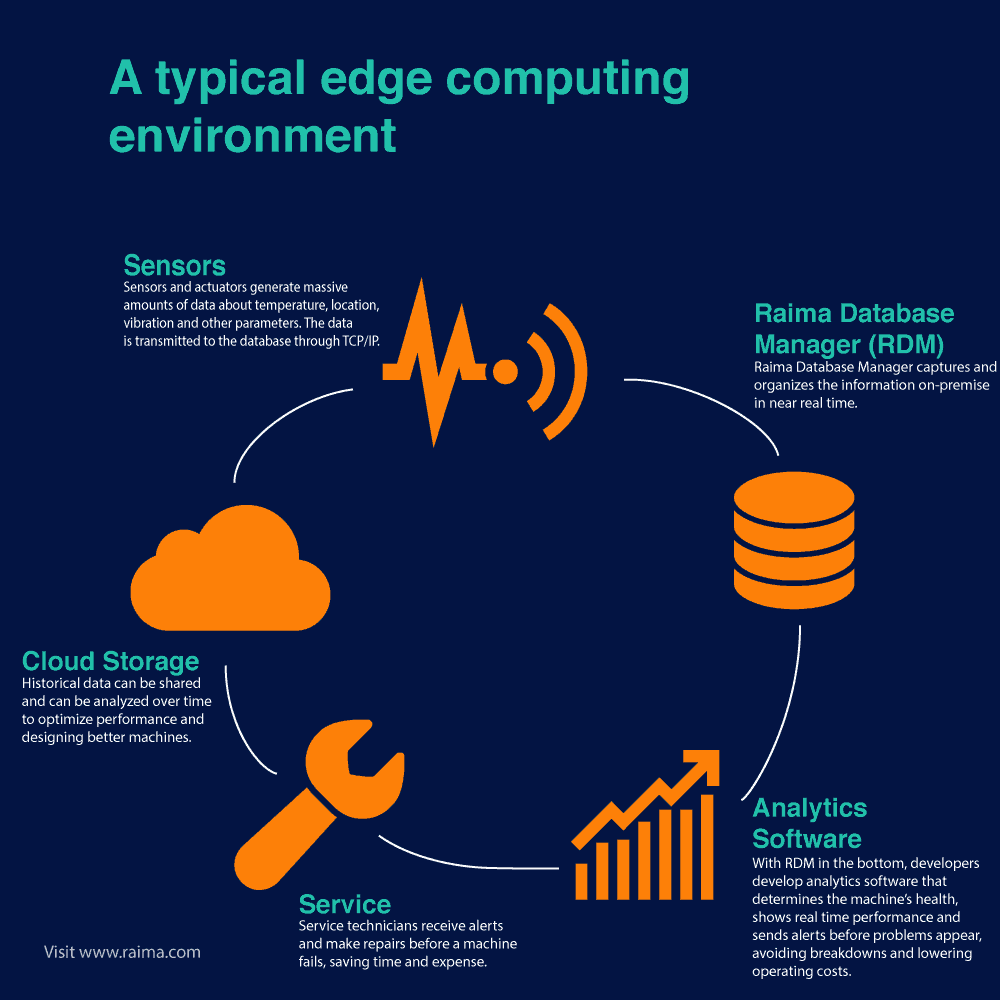

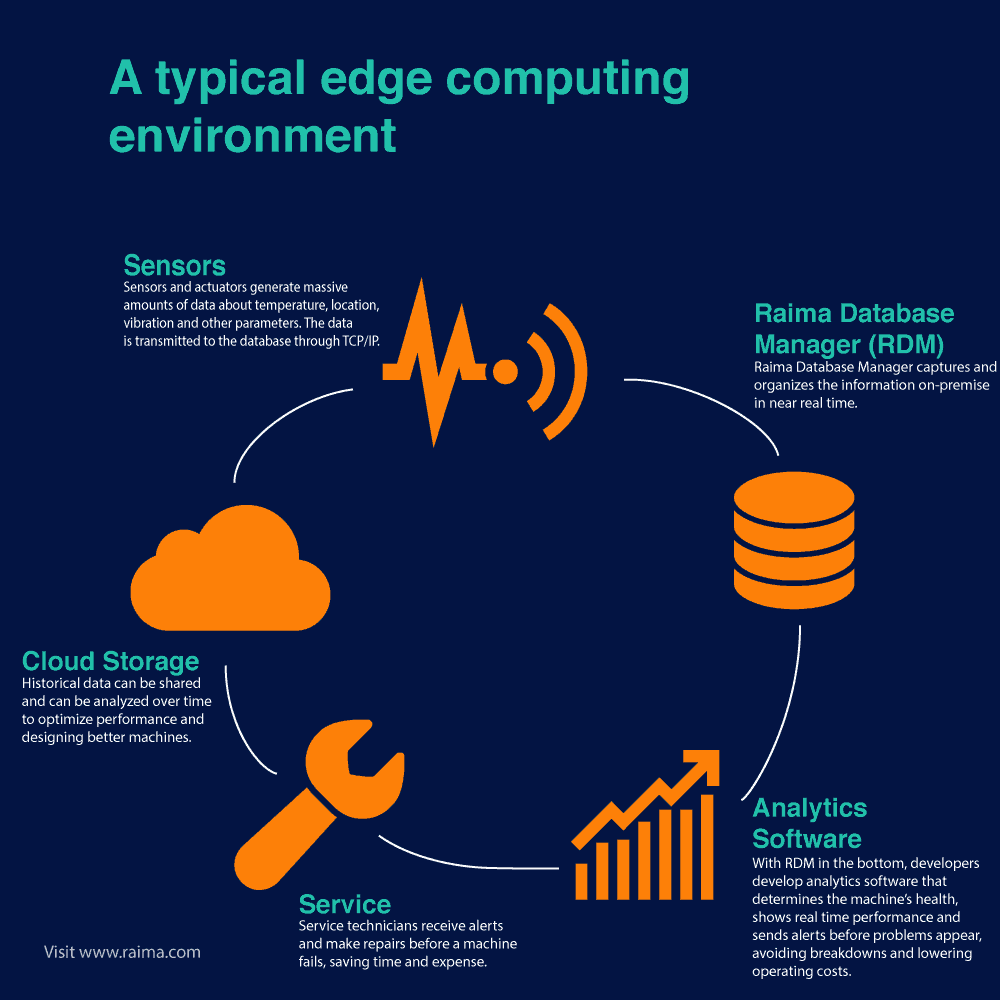

Source image : raima.com