5 Forex Trading Mistakes That Most People Make and How to Avoid Them

#image_title #site_title #post_seo_title #image_seo_title

Do you want to become an accomplished forex trader? Then you must understand the most common mistakes made by traders and how to avoid them. According to research, over 90% of all traders make one of five mistakes when trading forex that are costly. In this article, we’ll look at those five mistakes, why they’re dangerous, and how you can take steps to avoid them. Read on to learn how to reduce the risks associated with forex trading and improve your chances of success.

Introduction

Forex trading can be a lucrative form of investment, but it’s essential to be aware of the common mistakes traders make. Without proper knowledge and an effective strategy, traders may find themselves losing more than they win in their trades. In this article, we will take a look at the five most common mistakes made by new and experienced forex traders and provide tips on how to avoid them. These mistakes include over-leveraging, jumping into the market without doing research, setting unrealistic expectations, not having a risk management strategy, and associating with the wrong people. By understanding what these pitfalls are and how to avoid them, you can increase your chances of achieving success in the forex market.

Over-leveraging is one of the most common mistakes that traders make. When a trader takes too much leverage from a broker, they risk depleting their capital if the position goes against them. To avoid this mistake, traders should use only as much leverage as they need for their trades. Jumping into the market without doing research is another common mistake. It’s important to study the basics before engaging in trades and to keep up with news related to the currency pairs being traded. Setting unrealistic expectations is also a mistake that many traders make. New traders often think that they can make huge profits overnight when the reality is that consistent profits require patience and discipline.

Not having a risk management strategy is also a major mistake. A risk management strategy helps protect traders from excessive losses due to incorrect position sizing or poor trade entries. Lastly, associating with the wrong people can be a costly mistake for forex traders. It’s important to choose mentors or trading coaches who have been successful in trading over a long period of time and who understand your trading goals.

Now that we have looked at the five most common mistakes made by forex traders, let’s take a look at some tips for avoiding them. The first tip is to educate yourself about forex trading so you can better understand how the markets work and how to make informed decisions about your trades. It’s also important to create a trading plan and a risk management plan so that you are prepared for any market situation and have clear strategies for managing risk and controlling losses. Additionally, setting realistic expectations is key to avoiding disappointment in the markets; expecting too much too quickly is often an unrealistic goal for most traders. Lastly, stay away from risky trading strategies such

Mistake #1: Over-Leveraging Forex

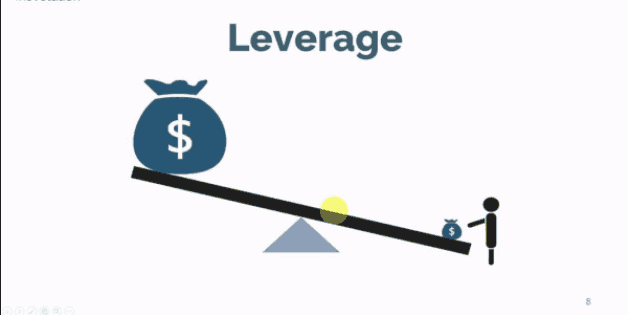

Over-leveraging is one of the biggest and potentially most costly mistakes that traders can make when trading forex. Leverage magnifies both potential profits and losses, and so it should be used with caution. Many traders become enticed by the lure of quick profits, leading them to take excessive risk through over-leveraging. This can result in large, unmanageable losses, especially in volatile markets or during high-impact news releases where stop losses may be triggered unexpectedly.

When trading forex, leverage can help traders maximize their returns when used appropriately. However, it is important to understand the risks associated with leverage and use it in a way that is appropriate for your trading style and goals. Taking on too much leverage can lead to large losses and emotional distress caused by watching open positions going against you. To avoid this situation, traders need to stay disciplined with their approach and not get too carried away with taking on too much risk.

Traders should only use as much leverage as they are comfortable with, as well as how much their capital allows for. It is important for traders to do their research before taking any positions and to be aware of how much of their account will be affected by any given trade. This can help traders gain an understanding of how different size positions will affect their accounts and also give them better insight into how to properly manage risk. Additionally, it is wise for traders to set up a risk management plan prior to entering a trade so that they know exactly how much they are willing to lose per trade if it goes against them.

In conclusion, taking on too much leverage can be very damaging when trading forex and should always be done in moderation. Traders who are aware of the risks associated with leverage and set up a proper risk management plan beforehand will have a better chance of avoiding major losses due to over-leveraging.

Mistake #2: Jumping Into the Market Without Doing Research Forex

One of the biggest mistakes any forex trader can make is jumping in without doing any research. Lack of research can lead to losses, so it’s important to understand the market before getting started. Being aware of the risk involved with foreign exchange market trading is also key to success; this means understanding the type of currency trades available and having proper risk management strategies in place prior to making any trades.

It’s important to have a basic knowledge of how the foreign exchange markets operate and develop a trading strategy that works for you by taking time to learn about different aspects of forex trading. Researching in-depth topics such as financial trends, economic reports and current events can help traders make more informed decisions when entering or exiting trades. Utilizing resources such as online tutorials, forex broker guides and books can provide valuable insight into successfully trading currencies and building a profitable portfolio.

When researching, it is also important to gain an understanding of the different types of orders you can use in your trading strategy. Market orders are used to buy or sell a currency at the best available price; limit orders set parameters for when you want your trade to be executed; and stop orders are used to minimize risk by setting a predetermined exit point which will automatically close a trade if reached. Being familiar with these types of orders can help traders reduce their risk and increase profits.

Staying up-to-date with relevant changes in the world economy is also beneficial; this includes monitoring currency exchange rates and keeping an eye out for political or economic news which might influence currency trends or pose a risk in terms of investment security. With proper research, analysis and practice, anyone can become an effective forex trader provided they have enough patience and dedication to succeed.

Mistake #3: Setting Unrealistic Expectations Forex

When first starting out in the world of forex trading, it is important to be aware of the potential pitfalls and set realistic expectations. Many novice traders become easily seduced by the promise of huge profits in a short period of time with little effort, but this is simply not achievable for most traders. Having unrealistic expectations can lead to disappointment and frustration when these expectations are not met.

Instead of expecting to make huge profits quickly, traders should focus on setting achievable goals that fit within the timeframe and risk appetite they have for their trading. The goal should be long-term success, not quick wins. By studying the markets, developing a proper strategy, and focusing on taking consistent small gains over time, traders can gradually increase their portfolio and build up a sustainable track record.

In addition, unrealistic expectations can also fuel overtrading which is when a trader enters too many trades during a short period of time in an effort to try and recoup losses or obtain larger profits more quickly. Overtrading can potentially be very detrimental to a trader’s account balance as it increases the risk of significant losses due to fatigue or taking bad trades due to impatience or lack of analysis. For example, if a trader is determined to make large moves in a short period of time, they may take larger risks than they are used to or employ strategies with high levels of leverage which magnify their potential profits but also significantly increase their risk level.

Having a realistic mindset around forex trading is an essential step in becoming a successful trader. The key is to remain patient, focused on making steady progress with your portfolio rather than aiming for overnight success stories or get-rich-quick schemes. It is also important to gain an understanding of the markets, develop reliable technical analysis skills, and practice proper money management techniques in order to minimize risk while maximizing profit potential.

Mistake #4: Not Having a Risk Management Strategy Forex

Risk management is an integral part of trading, and failing to have a strategy can be detrimental. Without a plan in place, traders may make unwise decisions that put their capital at risk. Therefore, having a risk management strategy is essential for any successful Forex trader. A risk management plan should include setting acceptable levels of losses, determining proper leverage amounts, and devising strategies for exiting positions when necessary.

Having a risk management strategy helps traders identify their risk tolerance and develop rules for executing trades. It also sets clear limits on what risks and rewards are acceptable during any given trade or investment period. Once these limits are set, traders must stick to them while they’re trading in order to ensure they don’t overextend themselves or take on too much risk. Additionally, having a plan in place allows traders to be prepared if things don’t go as expected; with clear exit strategies identified ahead of time, traders won’t be stuck holding onto losing positions out of fear.

Without a risk management strategy in place, traders may create unwise trades and put their capital at risk. They may also make decisions based on emotion or impulse rather than logic. This can lead to over-trading, which puts extra strain on the capital available and increases the potential for even greater losses. Additionally, taking on too much leverage can lead to bigger losses than expected if the position goes against them; without proper controls in place, traders can easily find themselves overextended and out of funds quickly.

Creating an effective risk management plan should be the first step in any trading journey. Traders should start by assessing their own financial situation and understanding how much risk they are able to take on. This will help them determine the amount of capital that is available for trading and what type of positions should be taken on with this capital. By setting realistic expectations around profits as well as losses, traders will be better equipped to stay on course with their trading plans instead of straying into risky territory that could cause major losses.

Once the overall risk levels are established, it is important to have specific rules in place for each individual trade or investment position that a trader takes on. This could include setting maximum levels of losses or gains per trade or establishing time frames in which the positions must be exited regardless of outcome – such as not letting any single trade last longer than one week. Having these rules written down will help keep traders focused and

Mistake #5: Associating with the Wrong People

Having the wrong people in your corner can be a detrimental misstep when it comes to forex trading. It is incredibly important to choose the right people when it comes to trading currencies; otherwise, you could end up associating with an unscrupulous brokers or questionable strategies that could spell disaster for your investments. Not taking the time to vet your partners in forex trading can have devastating consequences, so it pays off in the long run to ensure that you only associate with reliable players in the industry.

In addition, it’s important to be wary of growing popular movements or trends that may attract unqualified people looking to take advantage of inexperienced traders. These fly-by-night traders may not have the same interests as you and may end up causing more harm than good in your trading endeavors. Furthermore, it’s crucial to pay attention to how much influence these new “partners” have over you and your decisions; too much control can be detrimental for your long-term success as a trader.

To avoid this mistake, it’s recommended that you take some time to educate yourself on what makes a reliable partner and stick with proven methods when selecting a broker or mentor. It’s also important that you do your due diligence and research any potential partners thoroughly before entering into an agreement, and never jump on popular trends with unproven strategies; always vet them before investing. Finally, make sure to assess each individual’s interests in order to determine whether they are truly aligned with yours. Doing this will help you steer clear of bad partnerships that can cost you valuable time and resources in the future.

By taking these proactive measures, traders can make sure that they are associating with the right contacts who share their investment goals and objectives. After all, having the right people in your corner is essential if you want to maximize your returns and minimize losses in the forex market.

Tips for Avoiding Common Forex Trading Mistakes

When trading in the forex market, it is essential to avoid making common mistakes that can lead to costly losses. The following tips can help a trader stay on track and improve their chances of success.

First, it is important to educate oneself about the forex market. A thorough understanding of how the market works, the various trading strategies, and the economic, political and other factors that can affect currency values is key for any successful trader. This means doing research and using reliable resources to stay informed about the markets.

Another important step when trading forex is creating and sticking to a trading plan. A trading plan should include a strategy that outlines entry and exit points, as well as stop loss orders and risk management techniques. Developing a strict discipline plan to follow when entering and exiting trades can also be beneficial.

It is also essential for traders to set realistic expectations for how much money they can make from forex trading. While there is potential to make money, expecting overnight success is not realistic and will lead to disappointment in the long run.

In addition to having a trading plan, it is also crucial to have a risk management plan in place. Risk management must consider the amount of capital a trader has available and the maximum amount of risk he or she is willing to take on each trade. This will help reduce the chance of unwarranted losses due to over-trading or over-leveraging.

Before investing any real money, it is advisable for traders to practice by using a demo account first. A demo account enables traders to apply their strategies with fake funds so that they can become comfortable with their approach before risking real capital.

Finally, patience and discipline are two essential virtues when trading forex. It’s important not to get too emotionally involved with trades or focus on short-term gains rather than looking at longer-term goals. Cutting losses quickly and avoiding risky trades are also important components of successful forex trading.

By following these tips, traders will be able to avoid making costly mistakes when trading in the forex market and potentially increase their chances of success.

Conclusion

In conclusion, forex trading is a challenging yet rewarding venture and avoiding common mistakes can help traders maximize their chances of success. With an understanding of the common mistakes, along with sound strategies for avoiding them, forex traders can increase their chances of achieving their financial goals. Forex trading is not without risks, but by following these tips, traders can gain an edge in the markets and become successful. Successful forex trading requires a combination of education, discipline, risk management, and the right attitude – all of which should be done in order to limit potential losses and maximize potential profits. By doing your own research, setting realistic expectations and having a comprehensive risk management plan in place, you can reduce your risk of making costly mistakes and increase your chances of making consistent returns from the forex market.

The foreign exchange market can be a profitable and exciting venture, but there are a few common mistakes that traders should be aware of. Over-leveraging, jumping into the market without doing research, setting unrealistic expectations, not having a risk management strategy, and associating with the wrong people are all mistakes that can lead to financial losses. However, these mistakes can be avoided by educating yourself, creating a trading and risk management plan, setting realistic expectations, and staying away from risky trading strategies. By avoiding these common mistakes, traders can be more successful in their forex trading endeavors.